Page 240 - Annuaire Statistique Québec - 1956-57

P. 240

222 FINANCES PUBLIQUES-PUBLIC Jt'INANCES

b) succcssion de $40,000.00; huit eofrmts 1;) l';~t,ate of $40,000.00; eigl1/. children

de moins de vingt-cinq ans et domiciliés under tl\'enty·live years of H~(', domiciled in

da.'n~ la Province: exemption accordée, this Province: UlIlount f'Xf'mpLeù, $22,000.00;

~2,000.00; montallt imposable, $18,000.00; nmouM, taxable, $18,000.00; duLies, $648.00

droits, $648,00 au lieu de $1,440.00; insLead of $1,440.00.

c) succession de $40,000.00; einq enfants c) FBtute of $40,000.00; five cltildren un-

de moins de vingt-cinq ans et domiciliés dans der tlVellty-five ye!trs of 'Ige, and domiciled in

I~ Province: exemption sur $17,500.00; mon- this Province: a!Dount exemptud 517,500.00;

tant taxable, $22,500.00 au lieu de .$40,000.00; amount taxuble $22,500.00 instend of $40,-

droits, $750.00 t\U lieu de $1,440.00; 000.00; duties, $750.00 instead of $1,440,00.

d) succession de $25,000.00; aucun enfunt d) Estate of .$25,000.00; no surviving chil-

aurvivnnt: exemption Sur 510,000.00; mon- dreu: amount exempted $10,000.00; amount

tant taxable, $15,000.00; droits, $450.00 au taxable $15,000.00; duLies $450.00 instead

lieu de $750.00; of $750.00.

e) succession de $40,000.00; aucun enfant c) Estatc of $40,000.00; no surviving chil-

survi vunt: exemption SUI' $10,000.00; mon- dren; amount exempted $10,000.00; amount

tnnt impo~able, .$30,000.00; droits, .$1,080.00 taxatle $30,000.00; duLies $1,080.00 instcad

au lieu de $1,440.00. of $ 1.44D.OO.

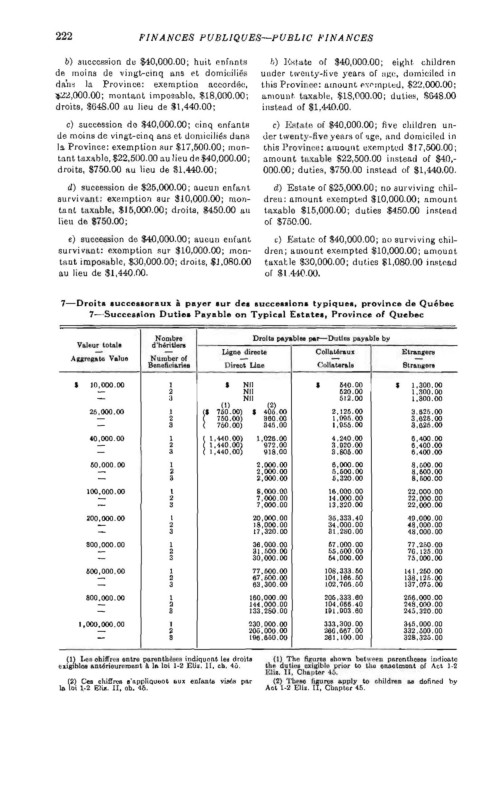

7-Droits eucceseoraux à payer eur dee Ilucceuion. typiques, province de Québec

7-Succe8llion Dutle. Payable on Typical Elltatee, Province of Quebec

},ombre Droltll l>l\yabl... per--DuU•• payabl. by

Valeur totllie d'h6riIJera

- - Ligne directe Colla16raul Elralllle·...

Aggrellale V.lue Number 01 - 1 - 1 -

Bonefici.fLritlB Direct Lino ColJat.e.al. Strangora

, , , ,

10,000.00 1 Nil MO.OO 1,aOO.OO

-

- 2 ;j Nil 520.00 1,300.00

Nil

612.00

1.800.00

(1) , 2

h )

25,000.00 1 7ll0.00~ 4 5.00 2,126.00 3.625.00

- 2 l' 760.00 360.00 1,005.00 a,625.00

- 3 760.(0) 845.00 1,050.00 3,625.00

40,OOO.eo 1 11 ,440.(0) 1,026.00 4,24.0.00 6,4.00.00

- 2 1,140.00 1l72.00 3.020.00 6,400.00

- 3 I,Ho.ool 1l18.00 a,805.00 6,400.00

60,000.00 1 2,000.00 6,000.00 8,600.00

- 2 2,000.00 5.600.00 8,500.00

- 3 2,000.00 ll,320.00 8,500.00

100,000.00 1 8,000.00 16.000.00 22.000.00

- 2 7,000.00 14,000.00 22,000.00

- 3 7,000.00 13,320.00 22,000.00

200,000.00 1 20,000.00 35,333.40 4.0,000.00

- 2 18,000.00 34,000.00 48,000.00

- 3 17,320.00 31,280.00 48,000.00

SOO.OOO.OO 1 36,eOO.00 67.000.00 77.2fiQ.00

- 2 al,fiOO.OO 55,500.00 76,125.00

- 3 30,000.00 M,OOO.OO 76.000.00

JjOO,OOO.oo 1 77.600.00 108.333.50 141,260.00

- 2 67,600.00 104,166.50 138.12fi.OO

- 3 63,300.00 102,706.60 137.075.00

SOO.OOO.OO 1 160,000.00 206,333.60 256,000.00

-

- 3 2 144,000.00 104,066.40 248,000.00

133,280.00

IGL003.60

245,320.00

1,000.000.00 1 230,000.00 333,300.00 315,000.00

266, (lB7 . 00

- - 2 S 206.000.00 261.100.00 332,000.00

11l6.650.00

328,325.00

(1) Lee ohiffre. ontre Pllrenth~ees indiquent le. droIt. (1) Tho figures .hown between pll••nthese. indieale

englblO<l antérieuromeot 1111\ loi 1-2 Eü•. Il, cb, 40. the dulie. e><igibl.e prior t.o th••"'''ltmont of Act 1-2

.Eli•. Il. Chaille. ·15.

(2) Ce. chiffre. e'llppliqueot OUI enlants vi.é. P"' (2) 'l'hellO iillure. apply ta chUdl'<ln "" donn.d by

il> loi }.2 ElU!. II, ob. 46. Act 1-2 EIl•. II, Cbaptor 45.