Page 164 - index

P. 164

t'i

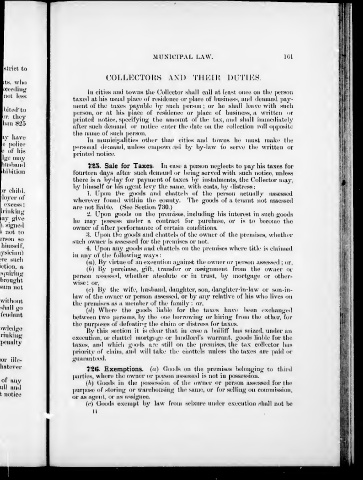

MUNICIPAL LAW. 1(51

COLLECTOKS AND THKIK DUTIES

In cities and towns the Collector .sliiiU call at least once on the jhtsoii

taxed at iiis usual plaee of residence di' ])Ia('e of business, ami demand pay-

ment of the taxes payid)le l)y such person; or he siiall leave with sucii

person, or at his place of residence or phice of business, a written or

printed notice, specifyinjf the amount of tlie tax, and shall inunediateiy

after such demand or notice enter tlie date on the collection roll opposite

tlio name of such person.

in municipalities other thar cities an<l towns he must make the

p"i'sonal demand, unless empowc .-ed by by-law to serve the written or

printed notice.

7'i!i. Sale for Taxes. In ease a person neijlects to j)ay Ids taxes for

fourteen days after such demaml or bein<;' served with such notice, unless

there is a by-lay fen* payment of taxes by instalments, the Collector may,

by Idmself or his aj^ent levy the same, with co.sts, by distress:

1. [^pon t'le j^oods and chattels of the per.son actually as.sessed

wlu'rever found within the county. The goods of a tenant not assessed

are not lial'le. (See Section 730.)

'2. Cpon goods on tiie premi.ses, including his interest in .such goods

lie may pt)sse.ss under a contract for purchase, or is to become the

owner of after performance of certain conditions.

•]. Upon th" goods and chattels of the owner of the premises, whether

such owner is assessed for the premises or not.

4. Cpon any goods and chattels on the premises where title is claimed

in any of the following ways:

(a). By virtue of an execution against the owner or person assessed ; or,

{!}) liy piux'iiase, gift, transfer or assignment from the owner or

per.son assessed, whether al)solute or in trust, by mortgage or other-

wise ; or,

(c) By the wife, husband, daughter, son, daughter-in-law or son-in-

law of the owner or person a.ssessed, or by any relative of his who lives on

the premises as a member of the family : or,

((/) Where the goods Iial)le for the taxes have been exchanged

between two ])ersons, by the one borrowing or hiring from the other, for

the purposes of did'eatin-^ the claim or ilistress for taxes.

By this section it is clear that in case a bailiff has seized, uniler an

e.xecution, or diattel mortg.tge or landlord's warrant, goods liable for the

taxes, and which g^ioils a:-e still on the i)remise», the tax colh'ctor has

priority of claim, and will take the cnattels unless the taxes are ])aid or

guaranteed.

Ti'Ui- Exemptions, (a) Goods on the premi.ses belonging to third

parties, where the owner or person assessed is not in possession.

(/)) (ioods in the possession of the owner or person assessed for the

purpose of storing or warehousing the .same, or for selling on connnission,

or as agent, or as assignee.

((') Goods exempt by law from seizure under execution .shall not be

U