Page 50 - index

P. 50

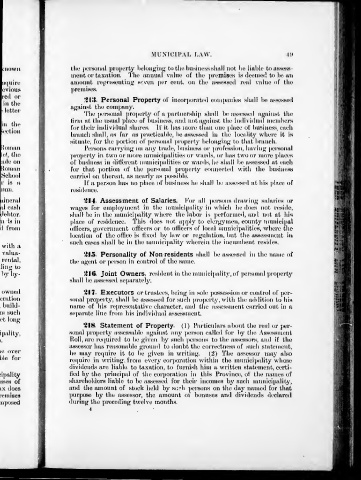

MUNICIPAL LAW. t!>

tlie (JOi'Hoiwil property l(ul(jii;^iii;f tit tlic l)U.siiirsHshiill not ho. lial)li' toasst'SM-

ineiit or tiixation, 'J'lie annual valuu ol' the premises is (luoniod to br an

amount ivj.M'csentinjjj swen per cont. on tlu' assessed real value of the

premises,

'illl. Personal Property ol' incorporateil coinpanies sliall l)e assesHed

Hf^ainst tlie company.

The personal property ot' a partnei'ship shall be; as-sessed ajfainst the

firm at tlu; usual ))laee of business, and not aj^ainst tlie individual members

for their individual shares. If it has more than one place of business each

brancli shall, as far as practicable, be assessed in the locality where it i.s

Hituate, for the pcn'tion of personal property belonj^inff to that branch.

Person.s carryiuff on any trade, business (ji- ])i'ofession, havin},^ personal

propei'ty in two or more municipalities of wanls, or has two or more places

of business in ditlerent Muniici])alitit's or wards, he sliall be assessed at each

tor that portion of the personal ]a'o])erty conntH-ted with the business

carrieil on thereat, as nearly as ])ossible.

If a person lias no place of business he shall be asscs.scd at his place of kmI^h!

residence.

*^I4. Assessment of Salaries. Kor all persons drawing; salaries or

waj^es for employment in the municipality in which he does not reside,

shall be in the nuuiicipality where the labor is performed, and not at his

place of residence. This does not a])[)ly to clerj^ymeii, county nujuicipal

otHcers, jrovernment oHicers oi' to otHcers of local miniicipalities, where the

location of the office is fixed by law or rej^ulation, but the assessment in

such cases shall be in the municipality wherein the incumbent resides.

'iiH- Personality of Non residents shall be as.se.ssed in the name of

the a^'ent or ])erson in control of the same.

'4Hi. Joint Owners, resident in the nuinicij)ality,of personal property

shall be assessed separately.

'il7- Executors or trustees, beinjj in sole possession or control of per-

sonal property, shall be assessed for such ])roperty, with the adilition to his

name of his representative character, and the assessment carried out in a

separate line from his individual assessment.

/JIH. Statement of Property. (1) Particulars about the real or per-

sonal property assessable aj^rain.st any person called for by the A.ssessmeiit

Roll, are re(|uireil to be ^iven by such persons to the assessors, and if the

assessor has reasonable groinid to doubt the correctiu-.ss of such statement,

he may require it to be i^jiven in writinif. (2) The assessor may also

require in writing from every corporation within the nnuiicipality whose

dividends are liable to taxation, to furnish him a written statement, certi-

fied by the principal of the corporation in this Province, of the names of

shareholders liable to be assesscnl for their incomes by such inunicijjality,

and the amount of stock held by si:"h persons on the day named for that

])urpose by the assessor, the amount ol bonuses and dividends declared

during the preceding twelve months.