Page 46 - index

P. 46

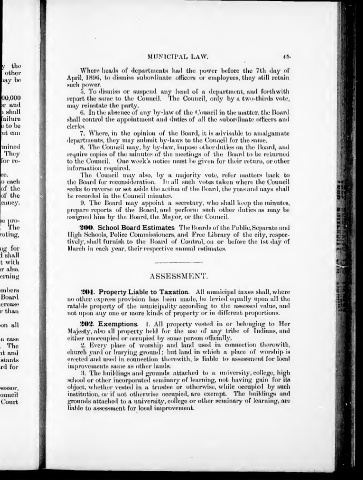

MUNICIPAL LAW. 46>

Where lieails of departiiioiitH hail tlie power before the 7th day of

April, 18S»(), to dismiss subordinate oHieers oi' employees, they still retain

such power.

."). To dismiss or suspend any head of a department, and forthwith

report the same to the Council. The Council, only by a two-thirds vote,

may reinstate the party.

(). In the aUseiice of any l)y-law of the ' 'ouneil in the mattei', the Hoard ii

shall control the appointment and duties of all the subordinate officers and

clerks.

7. Where, in the o[)inion of th(; Ijoard, it is advisabh; to amali^aniate

departments, they may submit by-laws to the Council for the .same.

8. The Council may, by by-law, im])ose other duties on the IJonrd, and

re([uire copies of the minutes (jf the meetin<^s of the Board to be returned

to the Council. One week's notice must Ik; <riven foi' tlu'ir return, or other

information re(|uired.

'llw Coiuicil may also, by a majority vote, refer matters back to

the Board for reconsideration. Im all .such votes taken where the Council

I

seeks to rev(!rse or set aside tin; acliou of th(! IJoai'd, the yeas and nays shall

be recorded in the Council minutes.

9. The Board may appoint a secretary, who shall keep the minutes,

prepare reports of the Board, and perform such other duties as may be

assii^rned him by the Boai'd, the Ma^'or, or the Council.

m

•400. School Board Estimates The Boards of the Public,Separate and

t»i> I

Hiirli Schools, Police Commissioners, anil Free ijif)rary of the city, respec-

?!

tively, shall furnish to the Hoai'd of Control, on or before the 1st day of

'i

March in each year, their respective annual estimates.

m

5

ASSESSMENT.

*iOI. Property Liable to Taxation. All uumicipal taxes shall, where

no other express provision has been made, be levied e(|ually U[)on all the

ratable j)roperty of the nnuiicipality accordin<'' to the assessed value, and

not upon any one or more kinds of property or in different proportions.

*iO*i. Exemptions- I. All property vested in or belon<jin<j to Her

Majesty, also all pro|)erty held for the use of any tribe of Indians, and

either uni)ccu|)ied or occupied Iiy some person ofHcially.

2. Kvery jdace of woiship anil land used in connection therewith,

church yard or buryini^ (ground : but land in which a place of worship is

erected and used in connection therewith, is lial)le to assessment for local

improvements .snme as other lands.

'A. The build ini,fs and ifrount Is attached to a university, college, high

school or other incorporated seminary of learning, not having gain for its

object, whether ve.stetl in a trustee or otherwise, while occupied by such

institution, or if not othei'wise occupied, are exem[)t. The buildings and

grounds attached to a university, college or other seminary of learning, are

liable to assessment for local improvement.